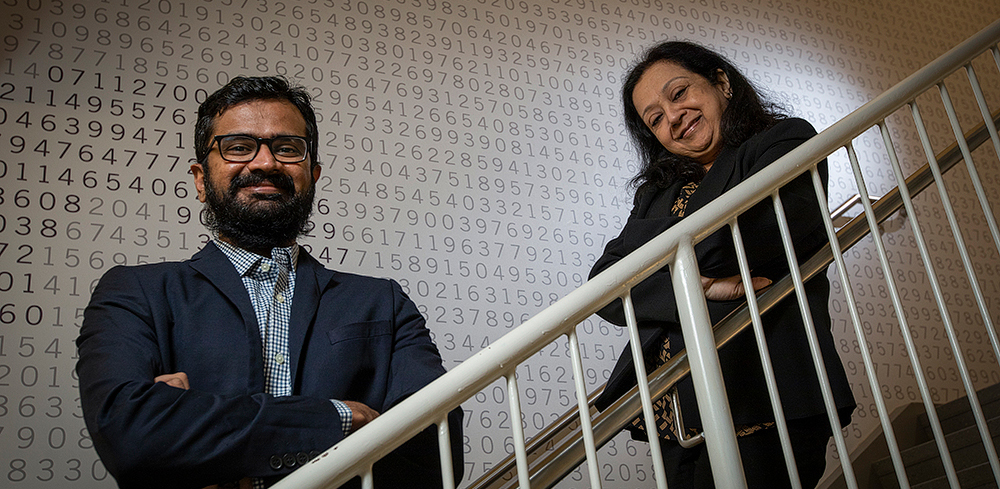

TCU Neeley Marketing Professors Minakshi Trivedi and Sarang Sunder show that the possibilities for big data are as endless and the numbers themselves.

March 15, 2021

By Barry Shlachter, TCU Endeavors

Big data is becoming, well, a big deal at TCU. Large-scale number crunching has spread across the campus in directions few people could have imagined a decade ago.

At the Neeley School of Business, Minakshi Trivedi, the J. Vaughn and Evelyne H. Wilson Professor of Marketing and chair of the Neeley Analytics Initiative, and Sarang Sunder, assistant professor of marketing, were featured in TCU Endeavors for their research with big data.

Late-Night Gaming

Trivedi and Sunder used big data to analyze the effectiveness of a South Korean policy that banned teenagers from playing video games at late hours. The ban was prompted by an addiction crisis that resulted in neglect of school activities, dropping grades and increasing isolation and depression, leading in severe cases to suicide.

But how effective was this effort? Trivedi and Sunder analyzed data from an online fantasy baseball game and found that casual players did indeed play less. As the researchers explain in a 2020 Marketing Science study, heavy gamers — the top 10 percent — found ways to work around the curfew by cutting into school and family time and in fact exacerbated their gaming-related problems.

In the long run, while the ban did prevent light players from becoming game junkies, Trivedi said, “it was of little value to the already heavy gamers. A more nuanced approach than a simple ban on all online teenage gamers would be required to find a solution to what is a growing global problem.”

Their findings may inform the design of other regulatory and policy solutions aimed at curbing the negative impact of social excesses, such as sugar taxes to curb obesity, heavier excise taxes to prevent smoking and bans on plastic bags to encourage eco-friendly behavior.

More importantly, big data could play a critical role in proving whether these attempts work and, if so, why.

Paying Cash for the Salad Bar

Sunder used big data to solve a seemingly intractable problem American businesses face: missing or partially observable data on customers.

Creating a profile of customers based on purchase history is easy when they hand over credit cards or use a loyalty card. “But the system breaks down when customers use cash,” said Sunder, assistant professor of marketing.

And then there are those who pay with credit cards sometimes, greenbacks other times, he said. “The company knows that $5 was spent; it just doesn’t know who paid for it.”

Cash transactions can account for as much as 40 percent of total sales, especially in gas stations and restaurants. Ignoring the cash customer when analyzing data, he said, could lead a company to make suboptimal marketing decisions.

For two years, Sunder and his research collaborator Yi Zhao, a marketing professor at Georgia State University, have been trying to decipher customer behavior when different payment instruments are used to predict behavior for all patrons. “How do you construct a holistic view? How do we characterize customers even though some behavior — say, cash transactions in this case — is invisible to the firm?” Sunder said. “The issue becomes even more complex when there are so many assortments and choice combinations that the customer has.”

For instance, which of the numerous combinations of salad bar items would a patron select when there are so many choices? Developing meaningful customer insights from data becomes especially difficult when the customer information may not be fully observable or when customer choices may include a large assortment of items.

In a recent working paper, Sunder and Zhao took sales data from a national fast- food chain and applied a modeling approach to figure the probabilities that particular customers would use cash. How? They developed a methodology to address the problem of missing data in a way that was sufficiently scalable to handle big data.

Once a customer’s information is matched with potential cash transactions, the company can then apply standard statistical techniques to analyze shopper behavior using a more holistic view.

In this way, the company has a better picture of who the customer really is, Sunder said, which allows the business to build robust marketing strategies and develop deep insights from data.

Learn more about the Neeley Analytics Initiative here.